Simplified and Enhanced Equity Options Pricing

Optimize Strategies, Track Pricing, and Effectively Manage Risk for listed and FLEX Options

The Precision Data You Need

By combining intraday and end-of-day data, the dataset delivers a comprehensive and robust information profile.

Optimize Trading Strategies

Make well-informed decisions with accurate and reliable option pricing.

Reduce Operational Costs

Streamline your pricing processes without hefty investments in infrastructur

Enhance Risk Management

Accurately track and manage pricing risks with real-time data integration..

How It Works

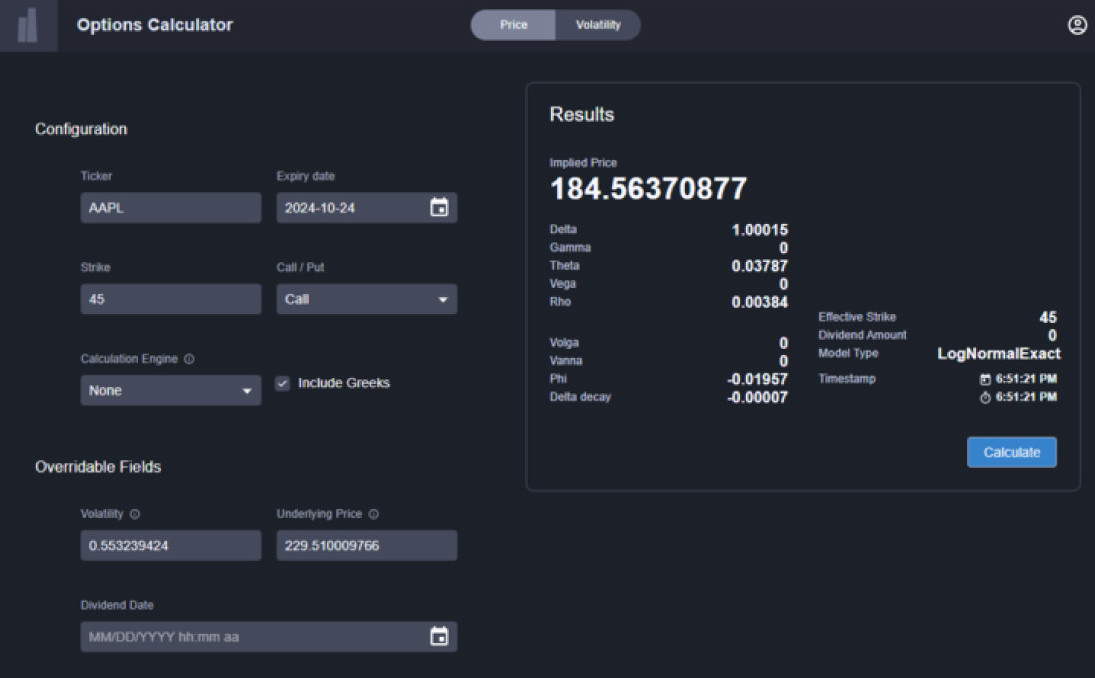

Simple Option Calculator

Allows users to calculate a single option price or volatility for a specific option using SpiderRock data inputs from a simple web-based GUI or programmatically via the API.

Users can subscribe to advanced functionality to override input values with proprietary assumption to better fit their specific needs.

Option Basket Calculator

Allows users to define a basket (up to 1000 option keys) of option by populating a table within the MLink API.

The basket or any option within can then be accessed programmatically throughout the trading day to update pricing based on the current market activity.

Unique Features

Trusted On Demand Pricing

SpiderRock’s complex option pricing models are used by thousands of institutional professionals each day to support live trading and risk.

FLEX Options Capability

Custom inputs support FLEX options, offering the ability to price customizable contracts.

Simplified Data Access

SpiderRock allows users to leverage our actively managed reference data library to compute Greeks, implied volatilities, and option pricing results.

Real-Time Market Integration

Unlimited data refresh access throughout the trading day using our high-capacity option data API.

Single Strike or Basket Delivery

Request single strike pricing or define and upload large baskets of options for bulk pricing.

Full Market Coverage

Pricing and volatility coverage of the US listed market, supporting both European and American style options.

Simplify and enhance the pricing of options

With SpiderRock’s MLink API, traders, portfolio managers, brokers, and Option ETF dealers and issuers alike can make well-informed option pricing decisions, optimize strategies, track pricing, and effectively manage risk—all within a streamlined, customizable API platform.

What Are FLEX Options?

FLEX options (Flexible Exchange Options) are customizable contracts traded on regulated exchanges that are designed to meet specific needs of institutional and advanced traders. These options allow for tailored strike prices, expiration dates, and exercise

styles, providing unmatched flexibility for portfolio strategies.

Their versatility makes FLEX options ideal for managing complex risk, hedging, and crafting Defined Outcome and Buffer ETF strategies.

Get Started Today

Contact SpiderRock to set up trial API access and compare our option pricing and workflow with your current solution.

API Fees are structured around number of users, all with access to unlimited API calls. Additional usage costs for message volume apply to users pricing large portfolios at low latency.